Wealth in the United States is concentrating into fewer and fewer hands, a trend we tracked in two previous Billionaire Bonanza reports in 2015 and 2017. This year’s edition focuses primarily on “dynastic” wealth that has passed from one generation to another within families. Our analysis is based on the Forbes magazine list of the 400 wealthiest individuals in the United States and the Federal Reserve Survey of Consumer Finances.

Wealth in the United States is concentrating into fewer and fewer hands, a trend we tracked in two previous Billionaire Bonanza reports in 2015 and 2017. This year’s edition focuses primarily on “dynastic” wealth that has passed from one generation to another within families. Our analysis is based on the Forbes magazine list of the 400 wealthiest individuals in the United States and the Federal Reserve Survey of Consumer Finances.

Key Findings:

- Three dynastic wealth families—the Waltons, the Kochs, and the Mars—have seen their wealth increase nearly 6,000 percent since 1982. Meanwhile, median household wealth over the same period went down by 3 percent.

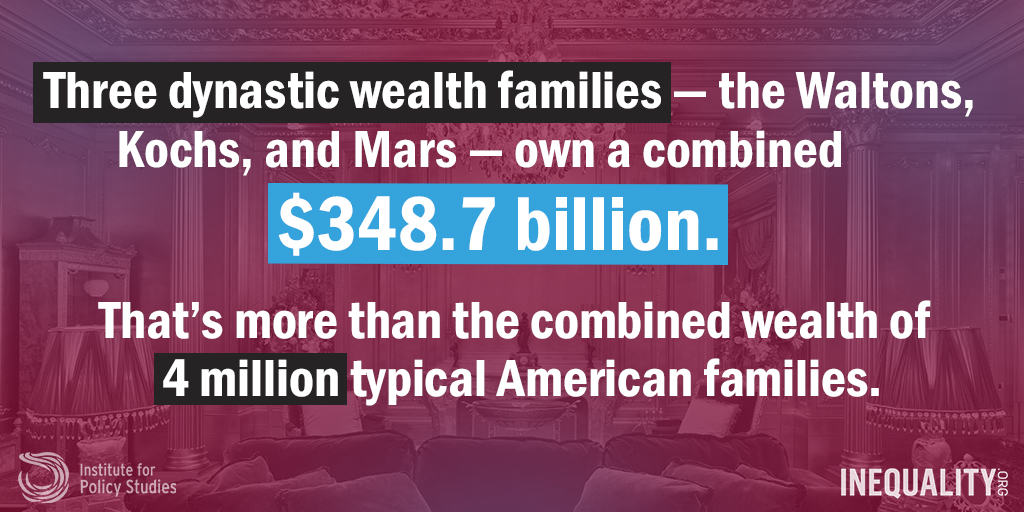

- These three wealth dynasties own a combined fortune of $348.7 billion. That’s more than four million times the median wealth of U.S. families.

- The dynastic wealth of the Walton family grew from $690 million in 1982 (or $1.81 billion in 2018 dollars) to $169.7 billion in 2018, a mind-numbing increase of 9,257 percent.

- Three individuals—Jeff Bezos, Bill Gates, and Warren Buffett—still own more wealth than the bottom half of the country combined.

- A third of the members of the Forbes 400 own fortunes derived from companies that were founded by earlier generations.

- The 15 wealthiest multi-generational dynastic families on the Forbes 400 own a combined $618 billion. Their parents or other ancestors founded all of the companies from which their wealth is derived.

- The Forbes 400 combined own $2.89 trillion dollars, more than the combined wealth of the bottom 64 percent of the United States. It’s also more than the GDP of Britain, the 5th-largest economy in the world. Just 45 individuals own half of this wealth.

- The median family in the United States owns just over $80,000 in household wealth. The richest person in the United States (and the world), Jeff Bezos, has accumulated a fortune nearly 2 million times that amount.

- The Bezos fortune expanded by $78.5 billion just in the last year to $160 billion. Even at the recently increased wage of $15/hour, a full-time Amazon worker would need to toil for 2.5 million years to generate this much money.

Recommendations:

Some dynastic families use their wealth and power to rig the political rules and preserve and expand their private wealth dynasties. While a number of solutions are required to reverse the gross wealth inequality outlined in this report, this report highlights two bold and innovative proposals to directly address the problem of dynastic wealth.

- Wealth tax: A direct tax on wealth paid by the wealthiest one tenth of one percent could generate significant revenue to be reinvested in creating and restoring opportunities for low wealth households to prosper. A 1 percent annual tax on the wealthiest 0.1 percent of households, those with wealth over $20 million, would generate an estimated $1.899 trillion in revenue over the next decade.

- Inheritance tax: The federal estate tax has been significantly weakened, most recently through the 2017 Trump-Republican tax cut. Taxing inherited wealth as income would help break up current and future wealth dynasties.

In order to successfully implement these policies, the U.S. must take leadership in advancing rules and global treaties that discourage aggressive wealth hiding and tax avoidance.