Dreams Deferred

How Enriching the 1 Percent

Widens the Racial Wealth Divide

Chuck Collins | Dedrick Asante-Muhammed

Josh Hoxie | Sabrina Terry

Introduction:

January 15, 2019, the release date of this report, would have been the 90th birthday of Dr. Martin Luther King, Jr. Dr. King envisioned a future in which deep racial inequalities were eradicated and he worked tirelessly towards that mission. Just as racial economic inequality is the foundation of racial inequality, similarly the racial wealth divide is the foundation of racial economic inequality. For this reason, our report focuses on the racial dimensions of wealth inequality in America

Wealth is a critical measure of financial security because it buffers families from the ups and downs of income changes and economic cycles and allows households to take advantage of socio-economic opportunities. This report highlights how historic racial wealth disparities have been perpetuated and increased by the trend towards extreme inequality in the United States. It also puts the racial wealth divide in the context of overall wealth inequality trends.

Dreams Deferred presents a snapshot of the racial wealth divide in the United States today, looking at the current state of household wealth, income, homeownership, debt, and other economic factors. It also reviews long-term trends that led to this current moment, as well as, the historical policies and contributors to this deepening divide. Finally, we shift our focus to solutions to address this growing divide with an eye towards bold, paradigm shifting ideas and policies.

Key Findings:

- Between 1983 and 2016, the median Black family saw their wealth drop by more than half after inflation, compared to a 33% increase for the median White household. Meanwhile, the number of households with $10 million or more skyrocketed by 856%

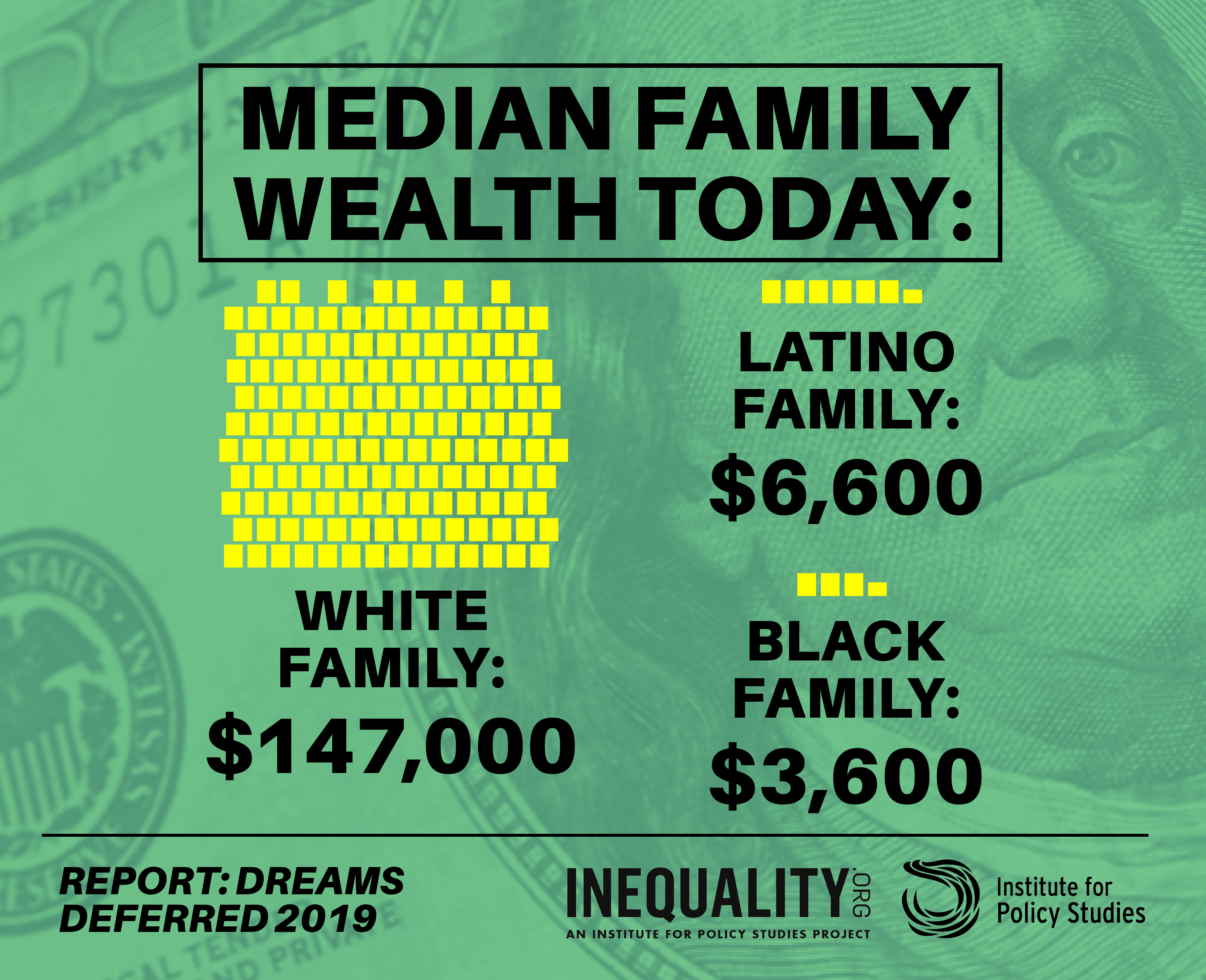

- The median Black family today owns $3,600 — just 2% of the wealth of the median White family. The median Latino family owns $6,600 — just 4% of the median White family.

- At this rate, by 2050, median White wealth will be $174,000, while Latino wealth will be $8,600 and Black median wealth will be $600. Black family wealth is on track to reach zero wealth by 2082.

More Key Findings

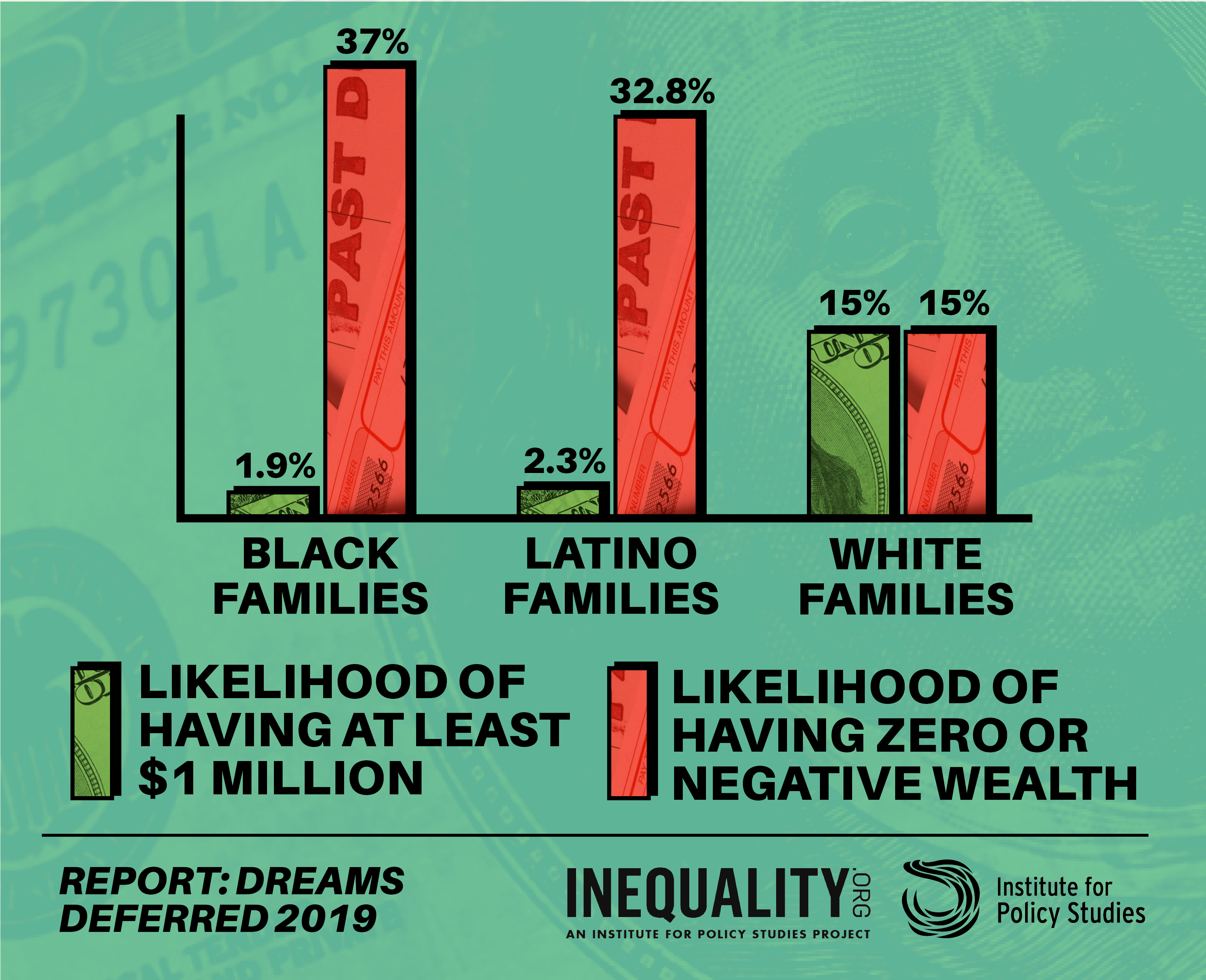

- Thirty-seven percent of Black families and 33% of Latino families have zero or negative wealth, compared to 15.5% of White families.

- The Forbes 400 richest Americans own more wealth than the entire Black population plus a quarter of the Latino population combined.

- Jeff Bezos, founder of Amazon, owns $160 billion in total wealth. That is 44 million times more wealth than the median Black family, and 24 million times more wealth than a Latino family.

- Systemic discrimination has made Black families 20 times more likely to have zero or negative wealth than to have $1 million, while white families have equal likelihood of either.

The Racial Wealth Divide Today

Going beyond the economic indicator of unemployment and looking more holistically at where the country is in terms of racial economic parity reveals a deep, pervasive and ongoing racial economic division.

The basic trend outlined in our findings shows wealth concentrating into fewer and fewer hands over time. These hands are overwhelmingly White. Asset poverty, different than just lacking income, means families lack the amount of wealth required to cover their basic needs for at least three months.

Read More

Wealth at the Middle

- Today, the median family in the United States owns $81,704, compared to $84,110 (adjusted for inflation) in 1983. That means despite three decades of economic growth and leaps in productivity, the typical U.S. family saw zero benefit, and their wealth go down.

- This reduction was not experienced evenly across racial groups. Median White family wealth today is $146,984, up from $110,160 in 1983, a 30 percent increase. So, the median White family wealth went up by tens of thousands of dollars while Black and Latino wealth bounced around mostly at asset poverty levels.

Wealth at the Top

- Three dynastic wealth families—the Waltons, the Kochs, and the Mars—have seen their wealth increase nearly 6,000 percent since 1982.

- Policies are skewed to help households with wealth continue to gain and maintain their wealth. Over the past 33 years, the top 0.1 percent grabbed 16 percent of the total gain in household and the top 20 percent of wealth owners captured 97.4, leaving just 2.6 percent to be shared by the bottom 80 percent of the country, just over 100 million families.

- The percentage of White families that are worth a million dollars has increased from 7 percent in 1992 to 15 percent in 2016. Only about 2.3 percent of Latino households and 1.9 percent of Black households had a net worth over a million dollars in 2016.

Wealth at the Bottom

- One in five U.S. families has zero or negative net wealth today, meaning they owe more money than they own.

- Black and Latino families are twice as likely to have zero or negative wealth as White families.

- 37 percent of Black families and 32.8 percent of Latino families have zero or negative wealth.

- Four in ten families could not come up with $400 cash if they needed it in an emergency.

While this report focuses primarily on wealth, household income, or the amount a family is paid in a year, contributes to a deeper understanding of the racial economic divide. In 2016, White median families were paid 1.7 times Black median families and 1.5 times Latino median families respectively

Another major indicator of economic well-being is the rate of homeownership. In 2016, 72 percent of White families, 44 percent of Black families, and 45 percent of Latino families owned their own homes. And White households accrue $1.34 for every $1 that median Black households accrue, and $1.54 for every $1 Latino households accrue, as a result of homeownership.

Historic and current public policies are largely to blame for this divide and smart, targeted public policy has the capacity to bridge the divide. This report shows we cannot address the racial wealth divide outside the context of the overall surge of wealth inequality in the society at large. We need policy solutions that reduce overall concentrations of wealth and power and those targeted to address the racial dimensions of wealth disparity.

Read More

Taxing the Top

It is impossible to address the racial wealth divide without also addressing our deeply unfair tax structure. Raising taxes on the wealthy could take many forms, including a wealth tax, inheritance tax, or taxing capital gains as ordinary income.

Revenue from these tax proposals should be invested in improving the wealth-building capacity of low-wealth families, especially those who have been historically excluded. Such opportunity investments could include establishing a children’s savings account or baby bonds, affordable housing, and securing Social Security.

Raising the Floor

Beyond addressing the racial wealth divide through the tax code and public expenditures, policies that would have a major impact on the racial wealth divide include raising the minimum wage, Medicare-For-All, and a federal jobs guarantee.

Over 50 years since Martin Luther King Jr.’s famous dream was shared with the nation, we have seen wealth concentrate among the wealthiest Americans and a polarizing racial wealth divide grow between Whites and Blacks and Latinos. A major economic shift in policy is needed to end the racial inequality of the past and create a new nation with opportunity for all.

Dreams Deferred expands on and updates two previous reports from the Program on Inequality and the Common Good at the Institute for Policy Studies, in collaboration with Prosperity Now: “The Ever-Growing Gap: Failing to Address the Status Quo Will Drive the Racial Wealth Divide for Centuries to Come,” in 2016, and “The Road to Zero Wealth: How the Racial Wealth Divide is Hollowing Out America’s Middle Class” in 2017. This report also builds on extensive research on the growing concentration of wealth in the United States catalogued in the “Billionaire Bonanza” report series released in 2015, 2017, and 2018. The most recent edition focused on the growing power and influence of intergenerational wealth dynasties.

Twitter and Facebook

Systemic discrimination has made Black families 20x more likely to have zero or negative wealth than to have $1M, while white families have equal likelihood of either. The U.S.’s #RacialWealthDivide is staggering: www.ips-dc.org/dreamsdeferred/ Share on Twitter Share on Facebook

Today’s #Forbes400 list own more wealth than all Black households in the U.S. PLUS a quarter of Latino households. This #RacialWealthDivide is deeply systemic—but there are solutions: www.ips-dc.org/dreamsdeferred Share on Twitter Share on Facebook

Today the median white family has 41x more wealth than the median Black family and 22x more wealth than the median Latino family. This #RacialWealthDivide is a direct result of policy discrimination: www.ips-dc.org/dreamsdeferred Share on Twitter Share on Facebook

The median Black family in the U.S. owns just 2% of the wealth of the median white family, and the median Latino family only 4%. Learn more about the systemic reality of the #RacialWealthDivide: www.ips-dc.org/dreamsdeferred Share on Twitter Share on Facebook

Download our Press Release [PDF]

Media Contacts:

Robert Alvarez

robert@ips-dc.org

202-787-5205

Jessicah Pierre

jessicah@ips-dc.org

617-401-1470